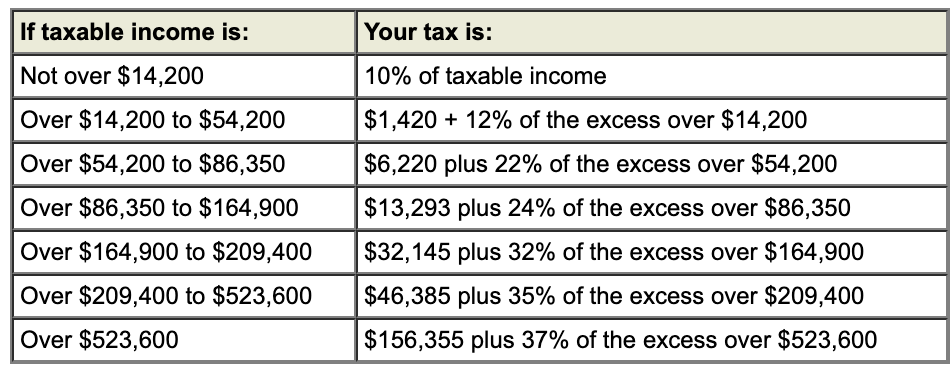

And so it goes through the various levels until the brackets top out at 37 (539,900 for single filers). The 2021 tax year refers to the period 1 March 2020 to 28 February 2022. Whether your taxable income is 40,000 a year, 400,000, or 40 million, the first 10,000 you earn is taxed the same (10). There are still seven in total: 10, 12, 22, 24, 32, 35, and a top. RTGS Annual tax table - 2021 USD Annual tax table - 2021 Tax files will be made available soon. The IRS did not change the federal tax brackets for 2022 from what they were in 2021.

2021 tax tables code#

The amount of secondary tax you pay depends on the secondary tax code you give your employer or payer. This helps you pay the right amount of tax so you do not get a bill at the end of the year.

See below, the tax tables for the various tax periods in both the local (RTGS/ZWL) and foreign currency (USD). Up to 31 March 2021 Secondary tax rates If you have more than one source of income, you pay secondary tax. The current tax year (1 March 2022 to 28 February 2022) in South Africa is called the 2022 tax year because the tax year is named by the year in which it ends. Chart of selected general business tax credits Quick guide to business expenses Frequently used IRS phone numbers Payroll deposit deadlines Employer-. The Zimbabwe Revenue Authority (ZIMRA) has issued tax tables for the 2021 tax year. 2021 Canada Federal, Provicial and Territorial Tax Tables The South African tax year differs from a normal calendar year, which runs from 1 January to 31 December. Instructions booklet 1040TT does not contain any income tax forms. The 2021 Canada Tax return is completed as one single calculation (except Quebec) with the total tax calculations, tax credits and exemptions centralised to simply tax calculations and 2021 tax returns. Booklet 1040TT contains the 2021 Tax And Earned Income Credit Tables used to calculate income tax due on federal Form 1040 and Form 1040-SR. The Minister announced tax changes to raise the zero-rate threshold for individual taxpayers from P36 000.00 to P48 000.00 with effect from 1 July 2021. The 2021 Tax Year in Canada runs from January 2021 to December 2021 with individual tax returns due no later than the following April 30 th 2022.Ģ021 Income Tax in Canada is calculated separately for Federal tax commitments and Province Tax commitments depending on where the individual tax return is filed in 2021 (due to work / location). In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1).

0 kommentar(er)

0 kommentar(er)